- Markets & Machines

- Posts

- Picture Abhi Baaki Hai Mere Dost

Picture Abhi Baaki Hai Mere Dost

Global Chaos & Why This Market Thriller Hasn’t Hit Box Office

Lights. Camera. Volatility!

Volatility — it’s the plot twist no one sees coming but everyone tries to predict. The Volatility Index (VIX) is Wall Street’s version of a suspense meter, showing how nervous (or chill) the market is about the next 30 days. Think of it as the fear barometer of finance.

Now zoom into India. The India VIX, based on Nifty Index options, plays the same role but in full desi style — capturing the mood of Dalal Street.

Then came COVID-19 — the global plot twist no one asked for. Suddenly, volatility didn’t just rise — it exploded. What followed was a divergence so wild, even seasoned traders were left staring at their screens like, “Ye kya ho raha hai?”

And now? The sequel to “Is India VIX Cheap or Expensive?” is unfolding — and many believe we’re only halfway through the script.

That’s where the twist is.

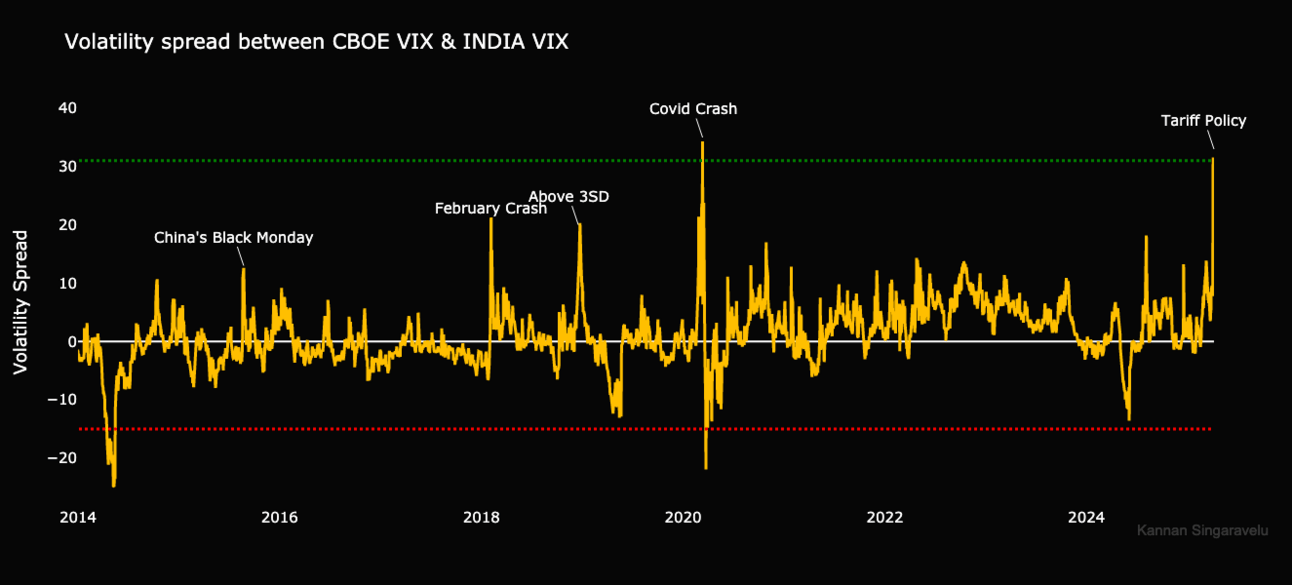

Volatility Spread between CBOE VIX and INDIA VIX

Act 1: When Two VIXes Part Ways

Let’s talk drama: the Volatility Spread — the difference between the CBOE VIX (US) and the India VIX. Normally, they stay somewhat aligned, like friendly co-stars. But on April 4, 2025, that relationship broke up — hard. It marked the second-highest reading after the COVID crash.

But here’s the hard truth:

The Nifty fell just 1.49% on April 4, and another 3.3% on April 7, taking the cumulative 2-day drop to under 5%.

India VIX, on the other hand, jumped more than 66% — that’s over 10 percentage points.

And the spread between the CBOE VIX and India VIX? A massive +6.5 standard deviations.

That’s not a mild breakup — that’s a full-blown Bollywood climax scene.

Act 2: “Volatility is at 45%! So It’s Expensive, Right?”

Not so fast. Just because the CBOE VIX touched 45% doesn’t mean it’s expensive. In markets, levels are always relative, never absolute. Let’s unpack that:

Implied vs. Realized Volatility

Implied Volatility (IV) = What traders expect

Realized Volatility (RV) = What actually happened

On April 4, 2025:

20-day RV: 12.82%

(Updated to 18.15% as of April 8, 2025)India VIX (IV): 13.76%

(Updated to 20.44% as of April 8, 2025)IV–RV Spread: 0.94 points

(2.28 on April 8 — not a record level!)

Translation?

The market is exhibiting high drama than what reality was dishing out. Despite sky-high spreads, traders were still underpricing risk — like selling umbrellas in a storm and pretending it’s just a drizzle.

India VIX ranked at the 75th percentile — no flashing signals yet. But relative to what was actually happening, it was insanely cheap.

Implied-Realized Volatility Spread

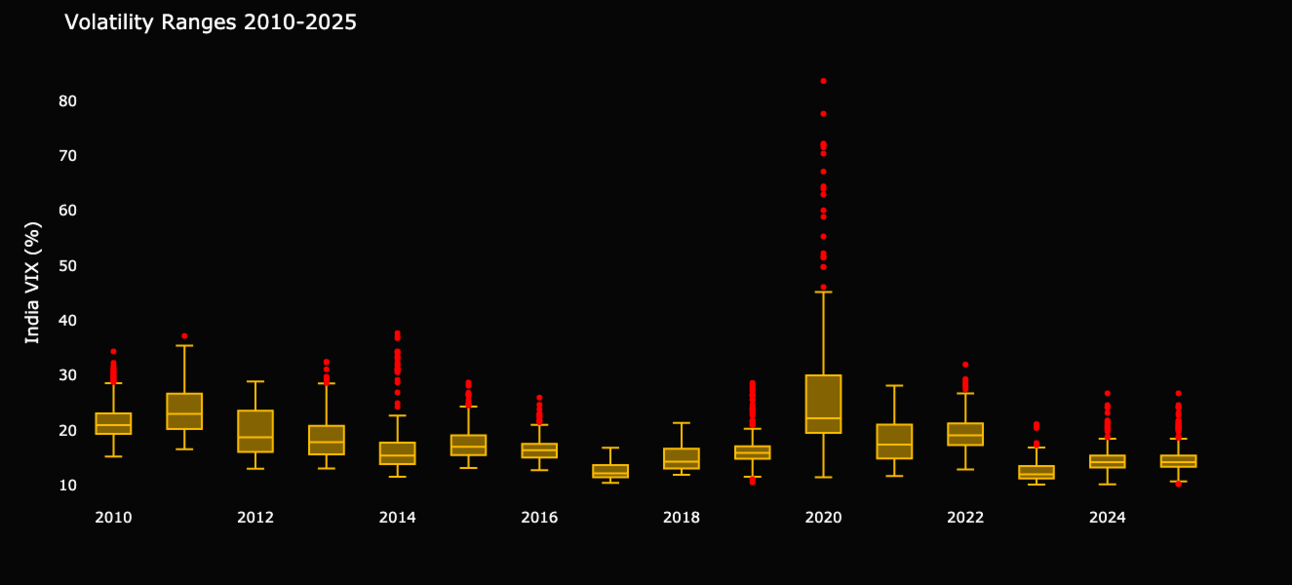

Act 3: Flashback – Long-Term Volatility Memory Lane

The India VIX, our hero, is currently hovering within ±1 standard deviation — a far cry from the 11 standard deviation spike recorded during the COVID crash. That COVID surge was second only to the legendary 2008 Financial Crisis.

And here’s the kicker: given the subdued RV, this could be a once-in-a-lifetime twist for long vol traders — if they truly believe the volatility spike will continue.

They’re waiting for the perfect sequel… maybe even a trilogy.

But we’re still not there yet.

Historical India Volatility Index

Act 4: Volatility — Pause or Plot Twist?

Here’s a classic Wall Street move: bet that volatility will calm down after a spike. It’s called mean reversion.

But here’s the twist: volatility clusters. When it rains, it pours. Big moves tend to be followed by… more big moves. So if you’re betting on calm skies right after a storm, you might get struck by lightning.

Many quant models that short volatility when it's “too high” have been caught off guard — like extras in a movie who didn’t read the full script.

Volatility Ranges 2010-2025

Sure, things might cool off for a bit — but with volatility still looking like a bargain bin at a Black Friday sale, betting on long volatility could be the real plot twist.

Final Frame: So, What’s the Takeaway?

"Kehte hain agar kisi cheez ko dil se chaho toh puri kainaat usse tumse milane ki koshish mein lag jaati hai." (They say if you truly desire something, the whole universe conspires to help you achieve it.)

So, is this chaos just a passing scene? Or have we entered a brand new volatility regime? Only time (and maybe a few more plot twists) will tell.

💡 TL;DR:

Volatility spreads between India and the US hit historic extremes.

US VIX spiked hard, but India VIX is still looking cheap.

Historical realized volatility (RV) says we’re okay… for now.

Pause or plot twist? Might want to watch the full movie before you place that trade.

Backstage? quantmod was calling the shots — because in this market drama, vibes don't cut it. You need code that slaps.